IDTechEx Discusses the Evolution of the Modern Electric Motor Market for Electric Vehicles

Electric traction motors may have been initially developed in the 1800s, but the market continues to evolve today, with the growing electric vehicle (EV) market providing new technologies, opportunities, and demand. IDTechEx has been writing research reports about electric traction motors in electric cars since 2012, but each year there are new developments that continue to surprise and impress.

Recently, there has been an increased focus on the materials used for electric motors and the underlying topology. Some want to improve features such as power and torque density with acquisitions related to axial flux motors. In contrast, others want to become more cost-effective and sustainable by reducing or eliminating rare earth.

In an ideal world, both of the above could be achieved simultaneously, but there is often a trade-off to be made. IDTechEx’s latest “Electric Motors for Electric Vehicles 2024-2034” iteration Electric Motors for Electric Vehicles 2024-2034” takes a deep dive into motor technology, market adoption, material utilisation, and market forecasts.

Materials and Rare-earths

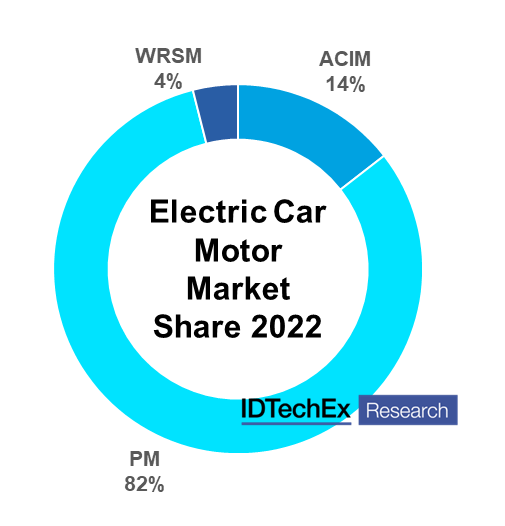

A key consideration for the EV motor market is that of magnetic materials. From 2015-2022 the share of permanent magnet (PM) motors in the electric car market remained consistently above 75%. Rare-earth magnets continue to be a concern in 2023 due to their supply chain being constrained to China and the prices starting to rise drastically again in 2021 (like they did in 2011/2012).

Several European OEMs have opted for magnet-free designs to avoid these concerns, including Renault and BMWs adopting wound rotor motors and Audi’s induction motors. In 2023, Tesla announced its next-generation motor would be a PM machine without rare earth, further bringing the focus to alternative magnetic materials such as ferrite magnets and their challenges to mass adoption.

For example, many OEMs have steadily reduced rare earth content in their PM motors through advanced material developments and optimised motor design. However, fully adopting rare earth-free magnets typically requires a significant hit to performance.

Without significant design changes, adopting a ferrite magnet would lead to power and torque loss of over 60%. Still, if various design aspects can be optimised, then the performance reduction from ferrite magnets could be offset. Players also look at newer magnetic alloys, such as Niron’s iron nitride magnets.

IDTechEx’s report analyses magnet-free motor designs, rare-earth reduction routes, and alternative magnetic materials options. IDTechEx predicts that PM motors will remain the dominant engine form (especially with China’s dominance in the EV market). Still, there will be further reductions in rare earth per motor and alternative magnetic materials, making more significant progress in the market.

Axial Flux and In-wheel Motors as Emerging Options

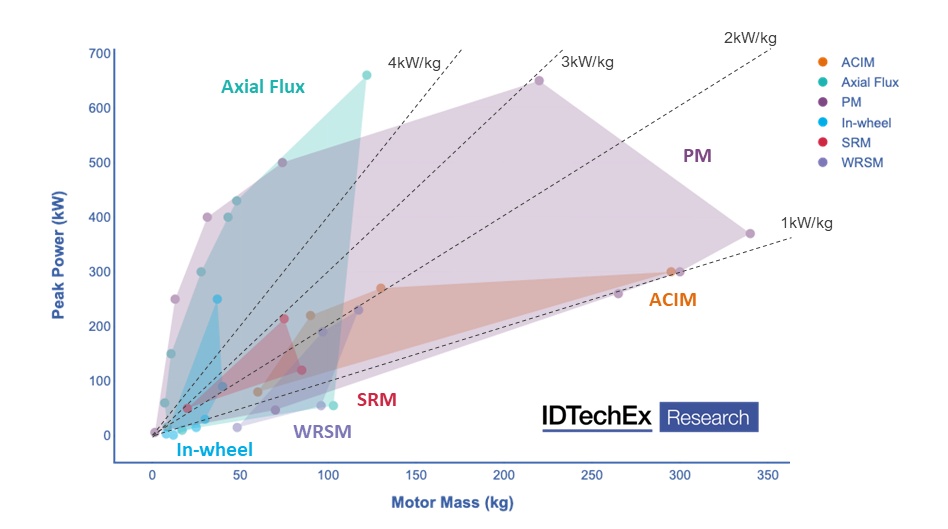

In addition to the traditional onboard radial flux motors in EVs, two emerging alternatives have gained a lot of interest but are at the early stages of market adoption: axial flux and in-wheel motors.

In axial flux motors, the magnetic flux is parallel to the axis of rotation (compared to perpendicular in radial flux machines). The benefits of axial flux motors include increased power and torque density and a pancake form factor ideal for integration in various scenarios.

Despite the previous lack of adoption, the technology has evolved to market integration. Daimler acquired key players YASA to use its motors in the upcoming AMG electric platform, and Renault has partnered with WHYLOT to use axial flux motors in its hybrids starting in 2025.

In-wheel motors have made it into some on-road vehicles, such as a limited quantity of Lordstown trucks. Still, Protean has also seen critical progress, where Dongfeng demonstrated the first homologated passenger car with ProteanDrive (in-wheel motor platform) in 2023 and followed this with fleet testing.

IDTechEx expects a significant increase in demand for axial flux and in-wheel motors for specific vehicle categories. However, it has yet to predict they will entirely displace the traditional onboard radial flux machines shortly. IDTechEx’s report, “Electric Motors for Electric Vehicles 2024-2034”, carries out performance and market analysis of emerging motor technologies with players, adoption, and 10-year market forecasts.

UP IN NEWS

- Setting New Milestones: Audi Middle East 2023 Performance Results

- Mercedes-Benz Vision One-Eleven: Progressive Interpretation of a 70s Brand Icon

- Hyundai IONIQ 6 Named Favorite Plug-in Vehicle by Midwest Automotive Media Association

- Tips for Classic Car Collectors Who Want the Best Display

- How Self-Driving Cars Work in Bad Weather

For all the latest automotive news, reports, and reviews, follow us on Twitter, like us on Facebook, subscribe to our YouTube page, and follow us on Instagram, which is updated daily.

Stay Ahead of the Curve

Unlock the World’s Leading Source of Automotive News and Analysis.

Autoscommunity.com provides innovative marketing and advertising solutions to support an advertiser’s specific campaign objectives.

Customised programs leverage the best of Autoscommunity.com. Please get in touch with our sales team today and see what our team can do for your custom advertising solutions.

-

Email: [email protected]

-

Please Read Our Privacy Policy

Why You Can Trust Autos Community

Our expert, award-winning staff selects the automotive-related news we cover and rigorously researches and tests our top picks.

Comments are closed.